Understanding Medicare Supplements: A Comprehensive Comparison

If you’re looking to compare Medicare supplements, understanding the intricacies of each plan is crucial for both Medicare insurance agents and enrollees. Medicare supplements, also known as Medigap insurance, play a vital role in providing coverage to fill the gaps after Original Medicare pays its share of covered medical expenses.

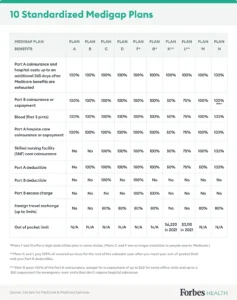

One key aspect to bear in mind is that Medicare supplement plans are standardized by the Centers for Medicare & Medicaid Services (CMS), ensuring that they provide the same benefits regardless of the offering company or the state of residence. With ten different plan choices named by letters A, B, C, D, F, G, K, L, M, and N, it’s important to note that plans with the same letter name only differ by price. The pricing of plans is determined by insurance companies based on the letter name and coverage area.

To understand the benefits associated with each plan, take a look at the chart below:

It’s vital to note that Medicare supplement Plan C and Plan F are exclusively available to those who turned 65 or qualified for Medicare before January 1, 2020. Additionally, some states offer a high deductible plan option for supplement Plans F and G, providing further flexibility.

When considering Medicare supplement plans K and L, it’s important to understand how much they pay for approved services before meeting the annual out-of-pocket limit and Part B deductible. Once both are met, the plan pays 100% of approved medical expenses. Plan N, on the other hand, pays 100% of the costs for Part B Medicare approved services, excluding copays for some office visits and some emergency room visits.

Before enrolling in a Medicare supplement plan, it’s crucial to evaluate your healthcare needs, budget, and potential future healthcare needs. This decision not only impacts your finances but also provides peace of mind. Given the varying costs of plans, working with a licensed Medicare agent who has access to the most competitive plans in your area can be immensely beneficial. These agents can provide a cost comparison and discuss coverage details that may not be immediately apparent.

Remember, each individual has unique healthcare needs, and what works for one person may not suit another. Therefore, it’s essential to consider the customer satisfaction record of each carrier and weigh the value of using a Medicare agent. While friends and relatives can offer guidance, the importance of considering one’s personal needs cannot be overstated. Finally, given the significance of healthcare coverage, beneficiaries should carefully consider all their needs and the available options.

For personalized assistance in understanding and choosing the right Medicare supplement plan, don’t hesitate to contact Gr8 Medicare Solutions, and for more detailed information, visit our website at www.gr8MedicareSolutions.com. Our licensed agents are ready to provide the guidance you need to make an informed decision and secure your healthcare future.